CedisPay's Financial Well-Being Model

Dear CedisPay Community

CedisPay’s purpose is connecting people to what is financially important in their lives (financial fulfillment) through friendly, reliable service, low-cost, fast financial services such as loans, development of good financial habits etc. Beyond providing responsible loans and financial education programs, we offer two key models designed to help you reach financial fulfillment.

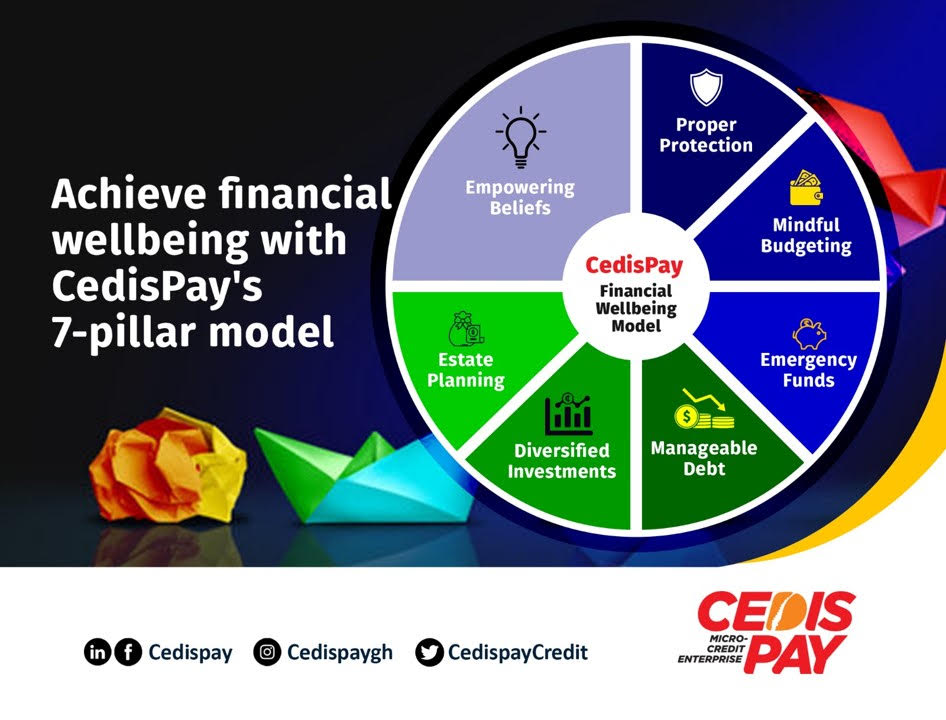

The CedisPay Financial Wellbeing Model

The CedisPay 7 Baby Steps for Wealth Creation

This newsletter focuses on the CedisPay Financial Wellbeing Model for Financial Fulfillment, which we believe is the fastest route to financial success

Achieving Financial Wellbeing: A Journey, Not a Destination

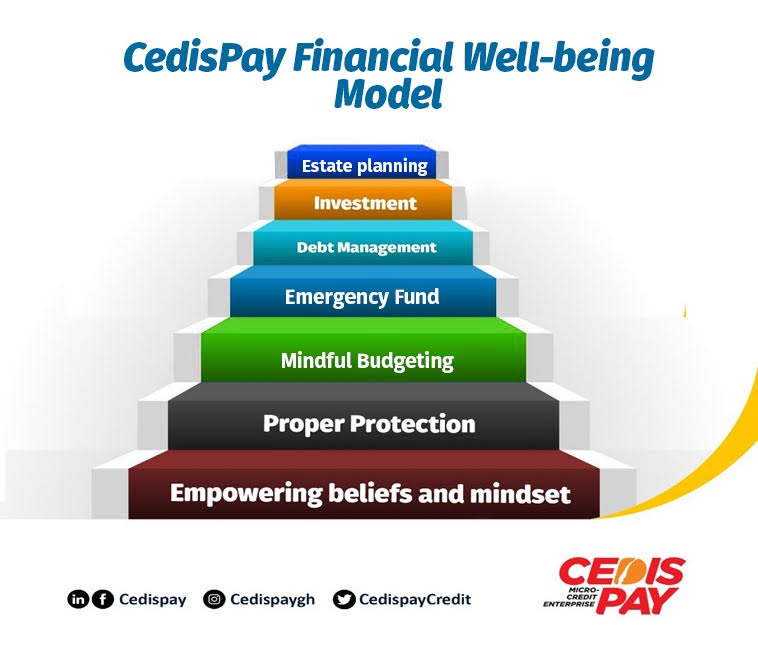

The CedisPay Financial Wellbeing Model is built on seven pillars that guide you towards financial freedom and peace of mind

- Pillar 1: Empowering Beliefs: Your mindset shapes your financial future. We help you develop a growth mindset, overcome limiting beliefs, and build confidence in your financial decisions. Empowering beliefs and a resilient mindset form the foundation for all other financial decisions, providing the motivation and resilience needed to navigate financial challenges.

- Pillar 2: Proper Protection: Protect your loved ones and assets with the right insurance coverage. We'll guide you in making informed decisions about life, health, and disability insurance. Proper protection is critical for long-term financial stability, safeguarding against unexpected events and mitigating financial impacts.

- Pillar 3: Mindful Budgeting: Take control of your finances with a budget that works for you. Effective budgeting is the cornerstone of financial stability, allowing you to allocate resources efficiently, track spending, and make informed financial decisions.

- Pillar 4: Emergency Funds Life is unpredictable, but your finances don't have to be. We'll show you how to build an emergency fund that covers 3-6 months of living expenses. This fund serves as a financial safety net, protecting you against unexpected expenses without derailing your long-term goals.

- Pillar 5: Manageable Debt: Get out of debt and stay out! Our debt management strategies will help you consolidate, reduce, and eliminate debt for good. Managing debt responsibly is essential for freeing up resources for savings and investment.

- Pillar 6: Diversified Investments: Grow your wealth with a diversified investment portfolio. Investments allow you to build wealth over time, generate passive income, and achieve financial independence. Once you have a solid foundation with empowering beliefs, protection, and an emergency fund, you can focus on long-term financial growth through investments.

- Pillar 7: Estate Planning: Protect your legacy and ensure your loved ones are taken care of. We'll help you create a comprehensive estate plan that includes wills, trusts, and beneficiary designations. Proper estate planning ensures that your assets are managed and distributed according to your wishes, providing peace of mind for you and your loved ones.

Importance of Order

The order of these pillars is crucial, as each build upon the foundation laid by the previous one. For example, having proper protection in place is essential before establishing an emergency fund, as unforeseen events can quickly deplete savings. Similarly, managing debt is a priority before investing, as clearing high-interest debt allows you to free up funds for investment and avoid unnecessary financial burdens.

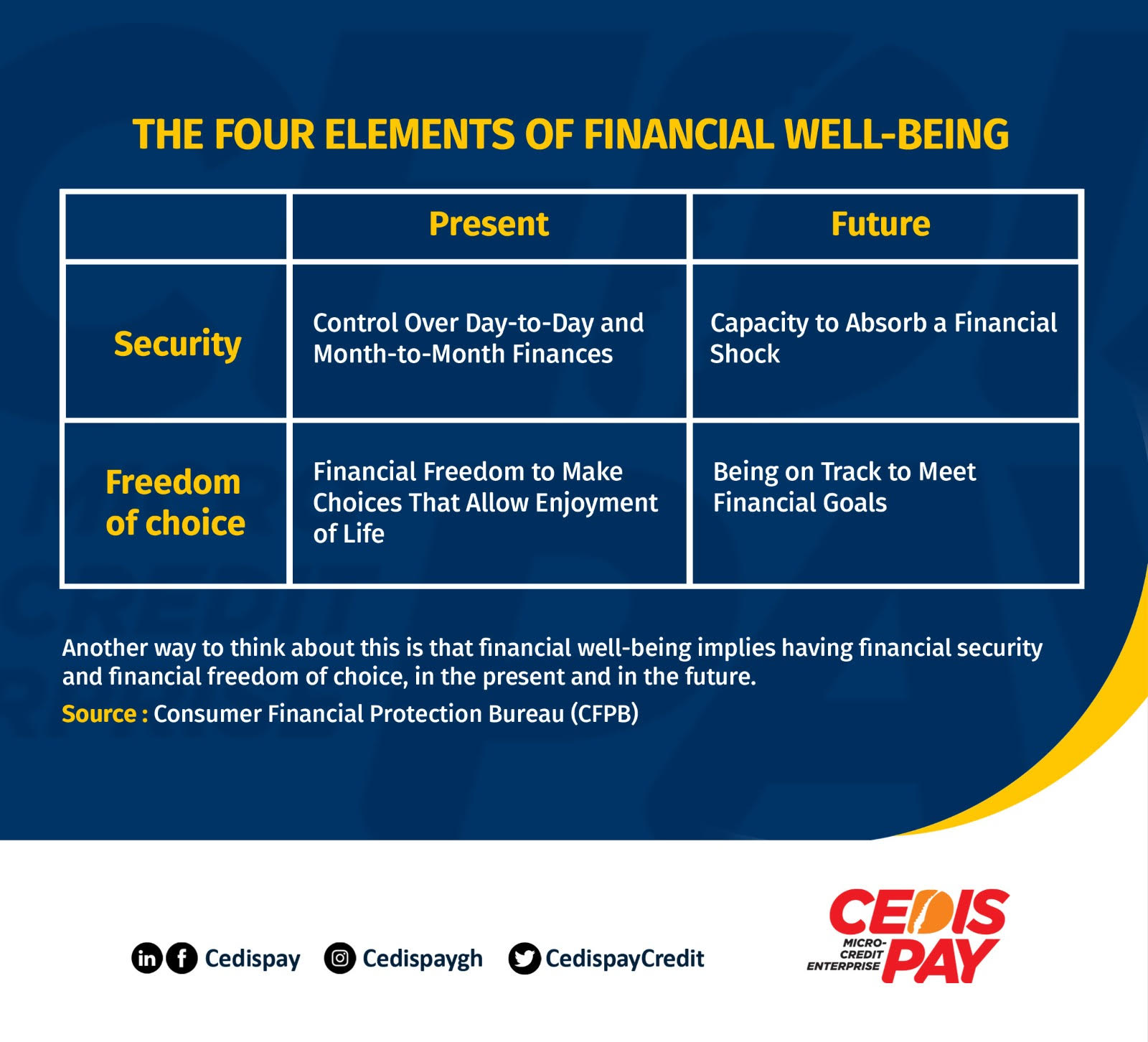

Integrating CFPB Principles

-

The Consumer Financial Protection Bureau (CFPB) identifies four key principles that align with our model:

- Control Over Day-to-Day Finances: Effective budgeting and mindful spending

- Capacity to Absorb Financial Shocks: Building emergency funds and having proper insurance

- On Track to Meet Financial Goals: Setting and progressing toward clear financial objectives

- Financial Freedom to Enjoy Life: Achieving financial flexibility and making choices that enhance quality of life By incorporating these CFPB principles into our model, we provide a holistic approach to financial well-being, ensuring you have control, preparedness, goal orientation, and freedom.

Thank you for choosing CedisPay. Together, let's embark on the journey to financial fulfillment and success. Warm regards, the CedisPay Team