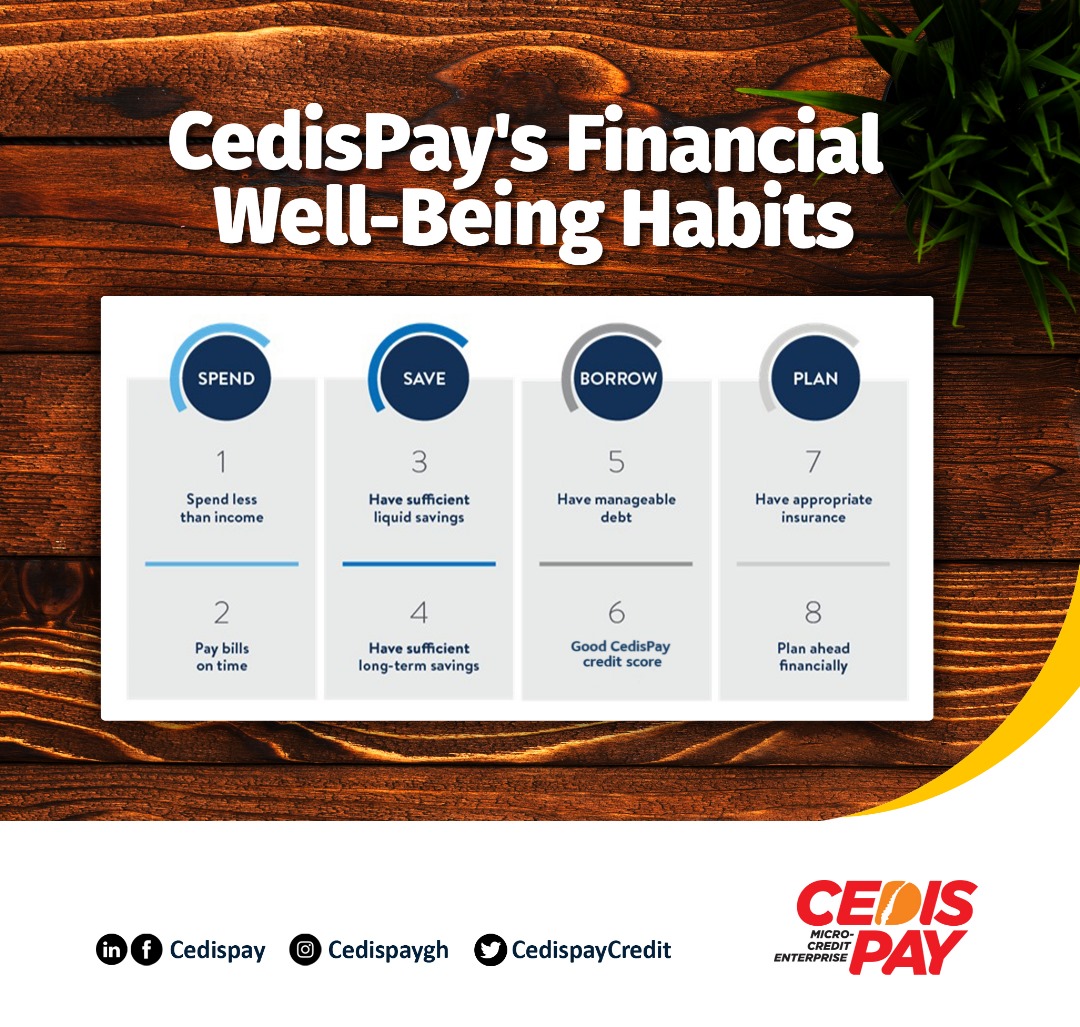

CedisPay's Financial Well-Being Habits

Introduction

CedisPay's Financial Well-Being Habits, is the second component of CedisPay's Financial Well-Being model and focus on cultivating positive financial habits, including:

- Spend Less Than You Earn: Financial health starts with prudent spending. Learn the art of effective expense management to ensure your income exceeds your expenditures. Our experts will guide you on developing smart spending habits that promote financial stability

- Pay Bills on Time: Timely bill payments are the cornerstone of financial responsibility. We'll provide you with strategies to stay organized and ensure your bills are paid promptly. By staying on top of your financial commitments, you'll maintain a healthy financial profile

- Build Your Savings: Establishing a robust savings account is essential for weathering life's unexpected storms. Our advisors will assist you in cultivating a savings mindset and implementing practical techniques to grow your nest egg. With a solid savings foundation, you'll be prepared for any financial challenge that comes your way

- Securing Your Future Through Wise Investments: Investing in your future is paramount for long-term financial security. Discover the art of wise investing and learn how to build a diversified portfolio that aligns with your goals and risk tolerance. Whether it's retirement planning or wealth accumulation, we'll help you navigate the complex world of investments

- Managing Debt Responsibly: While borrowing can be advantageous, managing debt is crucial to financial well-being. Our experts will educate you on responsible borrowing practices and provide strategies for keeping your debt levels manageable. With a proactive approach to debt management, you'll avoid financial pitfalls and maintain financial freedom

- Building a Strong Credit Score: Your credit score is a gateway to financial opportunities. Learn how to nurture and protect your credit score with our comprehensive guidance. From understanding credit factors to disputing inaccuracies, we'll empower you to maintain an excellent credit standing that opens doors to favorable lending terms and financial success

- Planning with Insurance: Insurance serves as a safety net for life's uncertainties. Our advisors will help you assess your insurance needs and select the right coverage options to protect your financial future. Whether it's health insurance, life insurance, or property insurance, we'll ensure you have adequate protection against unforeseen events

- Financial Planning: Strategic financial planning is the roadmap to achieving your goals. Our team will work with you to develop a personalized financial plan tailored to your aspirations and circumstances. From setting achievable goals to creating a roadmap for success, we'll equip you with the tools and knowledge to navigate your financial journey with confidence

Conclusion: With CedisPay's Financial Success Menu Plan, you have all the ingredients for a prosperous financial future. By mastering each course and embracing sound financial principles, you'll unlock the door to financial freedom and abundance. Let's embark on this journey together and pave the way for a brighter tomorrow