CedisPay is dedicated to empowering its customers to achieve financial well-being through a suite of proprietary models tailored to guide individuals towards holistic financial health. Understanding the CedisPay model involves a comprehensive five-fold approach aimed at empowering customers to achieve financial well-being:

-

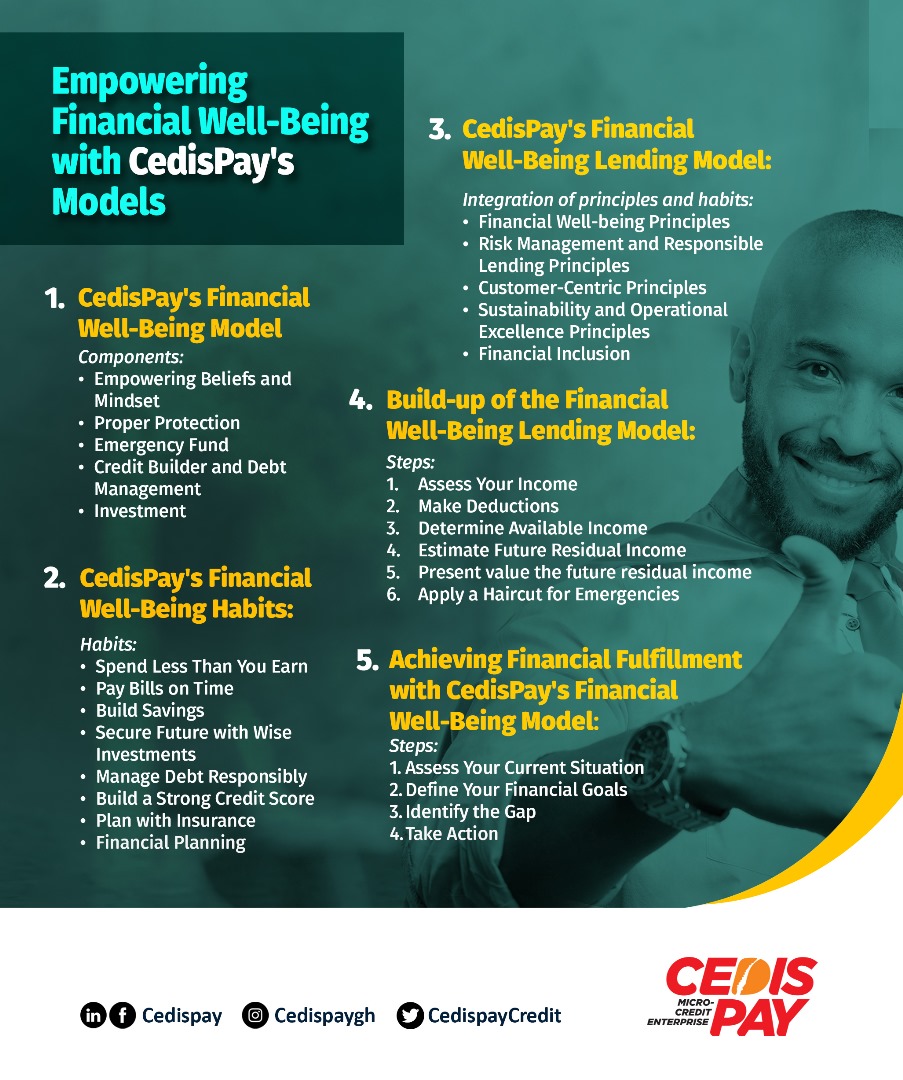

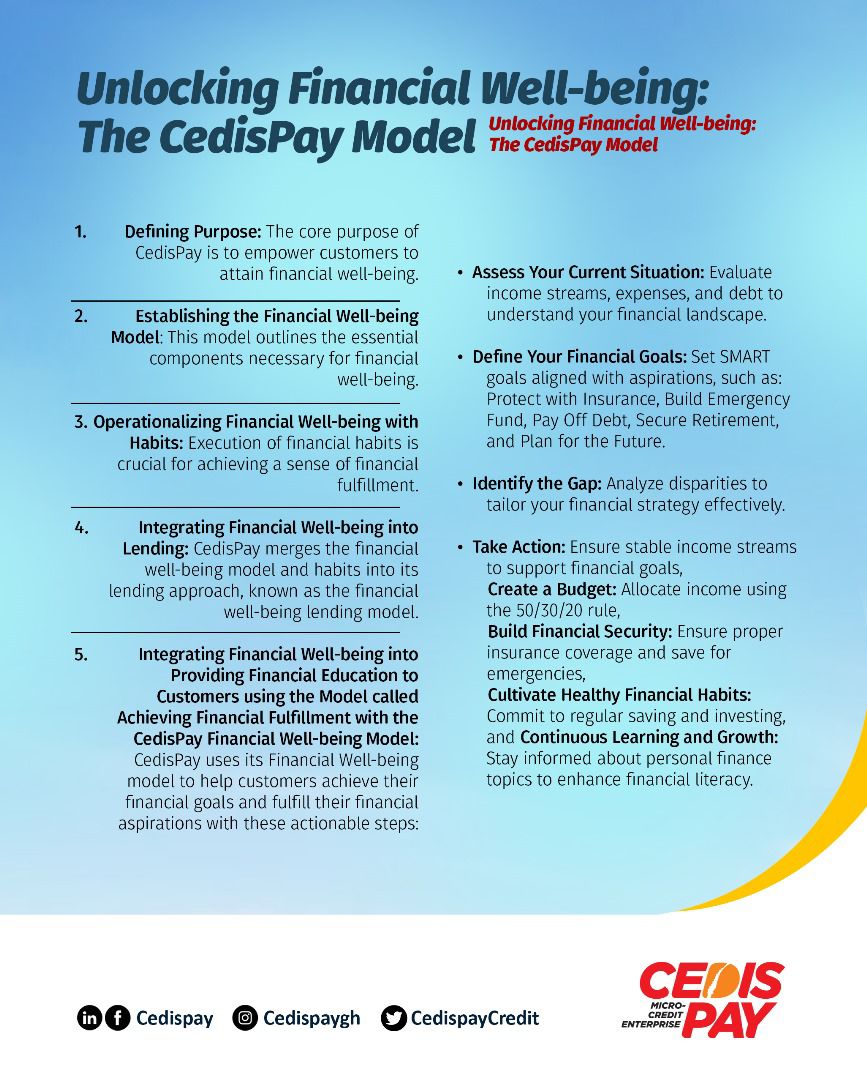

Defining Purpose:

- CedisPay's core purpose is to empower customers to attain financial well-being. We believe that financial stability is a fundamental aspect of a fulfilling life.

-

Establishing the Financial Well-being Model:

- This model outlines the essential components necessary for financial well-being

-

This comprehensive framework comprises five crucial components:

- Empowering Beliefs and Mindset

- Proper Protection

- Emergency Fund

- Credit Builder and Debt Management

- Investment

-

Operationalizing Financial Well-being with Habits:

- Execution of financial habits is crucial for achieving a sense of financial fulfillment. We emphasize the importance of cultivating healthy financial habits such as budgeting, saving, and investing regularly

-

Focused on cultivating positive financial habits, including:

- Spending Less Than You Earn

- Paying Bills on Time

- Building Savings

- Securing Your Future Through Wise Investments

- Managing Debt Responsibly

- Building a Strong Credit Score

- Planning with Insurance

- Financial Planning

-

Integrating Financial Well-being into Lending:

- CedisPay merges the financial well-being model and habits into its lending approach, known as the financial well-being lending model. This ensures that our lending practices are aligned with the financial goals and aspirations of our customers

-

Integrates principles and habits, serving as a guide for responsible lending practices and customer empowerment. Includes:

- Financial Well-being Principles

- Risk Management and Responsible Lending Principles

- Customer-Centric Principles

- Sustainability and Operational Excellence Principles

- Financial Inclusion

-

Integrating Financial Well-being into Providing Financial Education to Customers using the Model called Achieving Financial Fulfillment with the CedisPay Financial Well-being Model:

- CedisPay leverages its Financial Well-being model to help customers achieve their financial goals and fulfill their financial aspirations through actionable steps

-

Unlock the power of the CedisPay Financial Well-being Model to achieve your financial goals and fulfill your financial aspirations with these actionable steps:

- Assess Your Current Situation: Evaluate income streams, expenses, and debt to understand your financial landscape

- Define Your Financial Goals: Set SMART goals aligned with aspirations, such as Protect with Insurance, Build Emergency Fund, Pay Off Debt, Secure Retirement, Plan for the Future

- Identify the Gap: Analyze disparities to tailor your financial strategy effectively

-

Take Action:

- Ensure stable income streams to support financial goals

- Create a Budget: Allocate income using the 50/30/20 rule

- Build Financial Security: Ensure proper insurance coverage and save for emergencies

- Cultivate Healthy Financial Habits: Commit to regular saving and investing

- Continuous Learning and Growth: Stay informed about personal finance topics to enhance financial literacy. These models underscore CedisPay's commitment to fostering financial empowerment and well-being among its customers.