Introduction

Financial inclusion is a critical issue that impacts the lives of millions. CedisPay’s perspective on this topic is deeply personal, shaped by the founder Emmanuel Akrong’s journey towards financial well-being. Everyone’s viewpoint is informed by their unique experiences, and CedisPay is no different. To illustrate this, I’d like to share the story of Emmanuel's mentor, Shivani Siroya, the CEO of Tala. Her innovative approach to financial inclusion in Africa has significantly influenced CedisPay’s own path

The Inspiration: Shivani Siroya's Journey

Background

Shivani Siroya’s work at the United Nations brought her to Ghana, where she was tasked with evaluating the impact of UN programs on the local population. She quickly realized there was a significant gap in data and understanding regarding how people managed their finances.

Discovering a Solution

Without access to conventional data, Shivani took a hands-on approach. She followed program beneficiaries to their homes and businesses, observing their daily financial decisions and noting where they stored their information. She discovered that most of this data was stored on their mobile phones. This insight led her to the realization that people could be trusted based on their phone data, which could be used to administer loans.

Implementation

Leveraging her programming knowledge, Shivani developed a solution that utilized mobile phone data to provide loans. She successfully implemented this model in Kenya. Emmanuel often jokes that she left Ghana for him, setting the stage for his own journey in financial inclusion.

Emmanuel Akrong's Journey: From Financial Access to Financial Well-Being

A Visual Journey

-

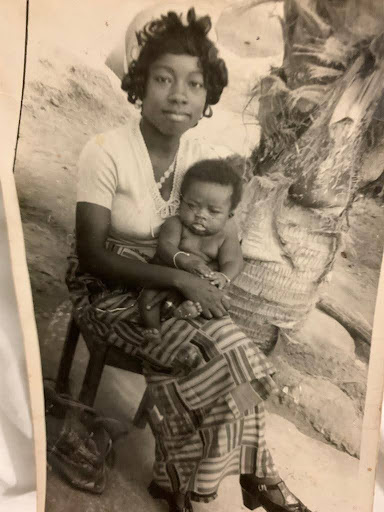

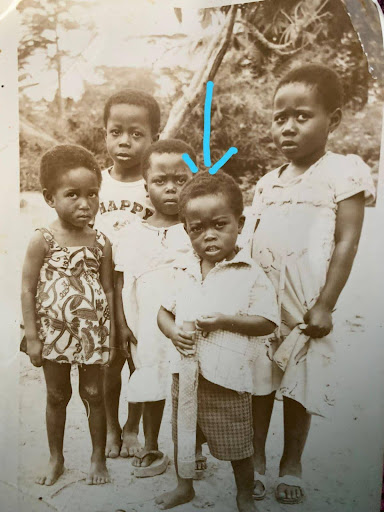

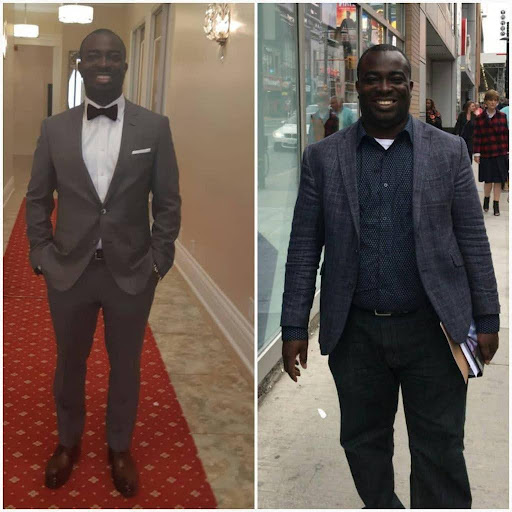

We have included three significant pictures from Emmanuel's life, highlighting his journey from struggle to success:

- Childhood Struggles: The first picture was taken at birth, and the second when he was 3 years old. In the first picture, he is not wearing any clothes because his parents couldn't afford good clothing. In the second picture, he is barefoot and not properly dressed because his parents couldn't afford to provide more

- Personal Transformation: The third picture has two parts. One was taken after he lost his wife and son in 2018, weighing 250 pounds with 36% body fat. The picture beside it was taken 8 months later, after consistent healthy eating and exercise. He lost 80 pounds, bringing him to 170 pounds and less than 10% body fat

-

Growing up in poverty brought three significant challenges:

- Education Barriers: Emmanuel couldn't secure university loans due to a lack of SSNIT-guaranteed family members

- Living Beyond Means: Frustrated by lack, he fell into a paycheck-to-paycheck cycle, overspending to escape his reality

- Fixed Mindset: He mistakenly believed long hours were the only way out of poverty, hindering his growth

Overcoming Financial Challenges

Determined to change his circumstances, Emmanuel focused on improving his financial habits and mindset. This journey transformed not only his financial situation but also his entire life. He came to understand that our minds, bodies, and souls are interconnected, and financial stress can deeply impact our overall well-being

Holistic Well-Being

Emmanuel’s journey towards financial stability was paralleled by a physical transformation—he lost 80 pounds in 8 months, significantly reducing his body fat. This experience reinforced the importance of a holistic approach to well-being, which became a cornerstone of his perspective on financial inclusion.

Purpose After Overcoming Poverty

After overcoming his personal struggles, Emmanuel's purpose is to empower individuals and communities to achieve financial well-being and break the cycle of poverty. He believes that everyone deserves access to responsible financial services, education, and guidance to make informed financial decisions.

How CedisPay is Achieving this Purpose

CedisPay's Purpose

CedisPay's purpose is to empower its customers and enable them to achieve financial well-being. Through responsible lending practices, flexible repayment options, and personalized financial guidance, we empower our customers to reach their financial goals and improve their overall financial health.

Products and Services

-

At CedisPay, we are dedicated to empowering individuals and communities through our range of services and products aimed at fostering financial well-being:

- Responsible Loans: We offer loans with flexible terms and low interest rates, tailored to meet your financial needs while promoting responsible borrowing and repayment practices.

- Empowerment Programs: Our programs are designed to instill empowering beliefs and mindsets, helping you build a strong foundation for financial success. We provide guidance and support to ensure you have the tools needed to achieve your financial goals

- Educational Tools: We offer a variety of resources to help you develop positive financial habits. From budgeting tools to financial literacy workshops, our educational offerings are designed to equip you with the knowledge necessary for making informed financial decisions

CedisPay: Empowering Through Financial Education and Mindset

The Vision

CedisPay was founded on the belief that true financial inclusion requires more than just access to financial services; it demands the promotion of financial well-being. Our mission is to empower individuals with the education and mindset needed to achieve their financial goals and find fulfillment in life.

The Approach

We focus on providing not just loans, but also comprehensive financial education. We teach our users how to manage their finances, save effectively, and develop healthy financial habits. Our programs are designed to foster a positive mindset, helping individuals overcome the psychological barriers that often accompany financial stress.

Emphasis on Growth Mindset

Foundational to achieving any goal and undergoing any transformation is a growth mindset—the belief that abilities and intelligence can be developed through dedication and effort. At CedisPay, every new hire is asked to watch two key videos; Start with Why by Simon Sinek and Credit for the Unbanked by Shivani Siroya. These videos emphasize the importance of understanding our ‘why’—the purpose driving us. Our core belief at CedisPay is the mind, body, and soul connection. This philosophy underpins everything we do, ensuring that our systems, processes, and people are aligned towards empowering our users.

Impact

By addressing both financial access and well-being, CedisPay aims to break the cycle of poverty and empower individuals to thrive. We believe that financial empowerment is about more than just money—it’s about creating a life of security, opportunity, and fulfillment.

Conclusion

Our personal journeys significantly shape our perspectives on financial inclusion. Shivani Siroya’s innovative use of mobile data to provide loans inspired Emmanuel to take a holistic approach to financial inclusion. His own experiences taught him the importance of financial well-being, and this philosophy is at the heart of CedisPay. Join us on this journey towards holistic financial inclusion, where we uplift and support each other to thrive. Together, we can make a difference.

Ready to Achieve Your Financial Goals?

Contact us directly at: +233 595 740 032, +233 595 741 614 or +233 552 386 593.

Learn more about our key products: responsible loans, empowerment programs, and financial education. Join CedisPay's social media community for updates, financial tips, and more:

- Subscribe to our newsletter on LinkedIn for the latest insights: Subscribe. We're excited about the journey ahead

Thank you for choosing CedisPay as your financial partner. We are committed to supporting you on your journey to financial prosperity.

Best Regards,

Emmanuel Akrong,

CEO, CedisPay